The forefront of cybercriminals is pushing the financial sector to invest in technology, especially Artificial Intelligence, to combat fraud in a digital age.

Conscious of the assets it protects, the financial sector – one of the most innovative – does not have the luxury of allowing security vulnerabilities. The challenge goes beyond being always one step ahead: technology must also protect user information, it must allow them to carry out processes easily, so that they have the best possible experience.

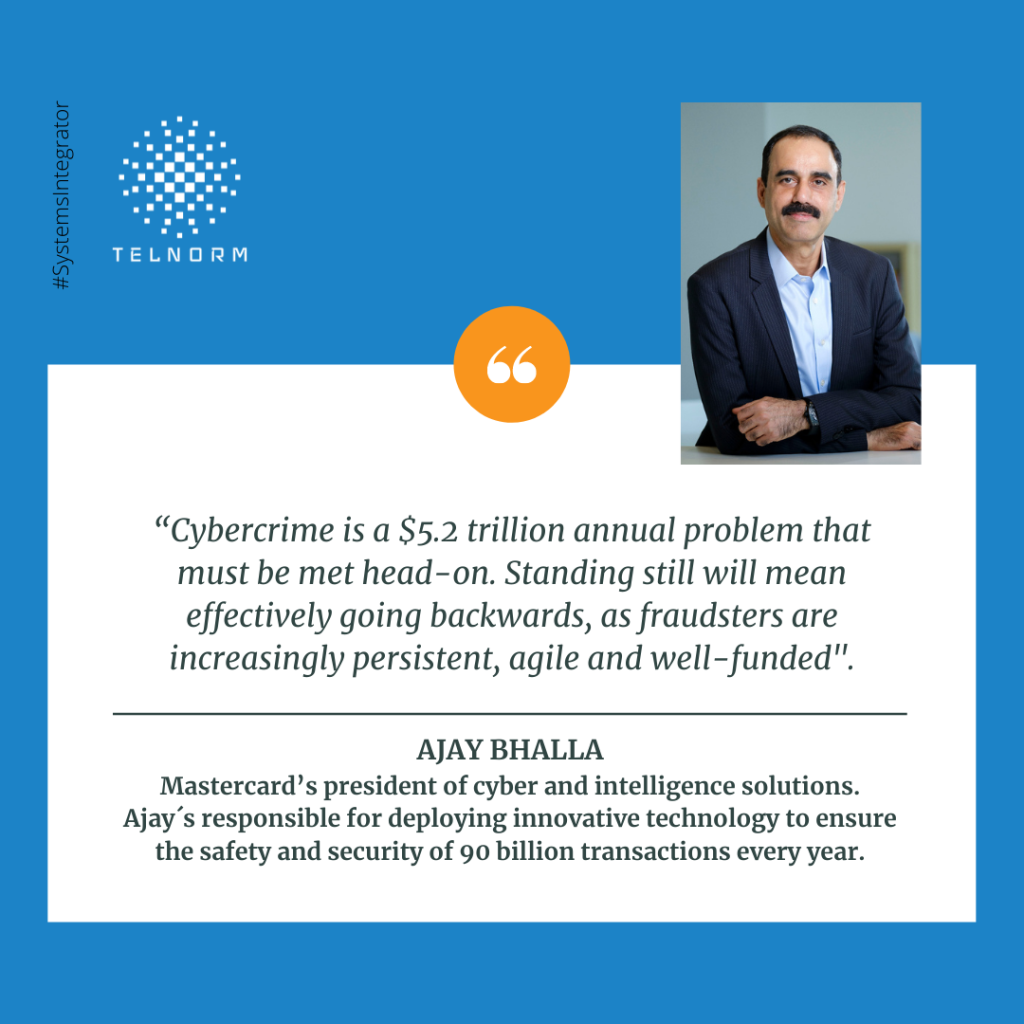

“Our business is based on trust, which is hard-won and easily lost”, said Ajay Bhalla, president of smart and cyber solutions, Mastercard.

The correct operating processes and standards must be in place from the outset so that both customers and businesses can have confidence in the technology and trust that it will be useful, safe and secure.

Coronavirus triggered the digital transformation, and cybercriminals have launched increasingly sophisticated attacks across a multitude of channels, taking advantage of heightened emotions and poor online security.

The landscape has rapidly evolved over the past year due to factors like the rapid growth of online shopping and the emergence of digital solutions in the banking sector and beyond. These changes have broken down the barriers to innovation, driving an unprecedented pace of change in the way we pay, bank and shop

Technology may be evolving rapidly, but a fundamental principle remains: it is not just the increasing number of transactions that attracts the attention of criminals, but the diversity of opportunities. Although technology is transformed, in the same way the way in which we use it is modified. That means we will always find new ways to lower our guard for evil characters to spy on our data.

Common activities such as sharing a contact list through a popular application or posting photos on social media can compromise a user’s security. Any part of our identity that we post online could eventually be used by scammers to try to take over our online accounts.

“Your digital identity, which includes all your images, videos and audio, will essentially allow hackers to create a complete identity of you, that looks exactly like you, in which you will not be involved,” says Vijay Balasubramaniyan, CEO from Pindrop, a security firm that develops technology to detect fraudulent phone calls.

In addition to having secure tools in both web and mobile applications, as well as in the hardware and software used in branches or ATMs, the financial sector must add other elements to strengthen security. Customer identification and authentication mechanisms at all contact points, including call centers or contact centers, must prevent spoofing and theft.

These innovations are transforming customer interactions with financial service providers. For example, there are AI-powered technologies with physical biometrics, such as face, fingerprints, and palm, to identify legitimate account holders. Also those that recognize behavioral traits, such as the way customers hold their phone or the speed with which they type, actions that scammers cannot replicate.

For three decades, at TELNORM we have led, enabled and supported our clients in the financial sector through multiple waves of change and technology evolution. With presence in the United States, Mexico, Colombia and Central America and the Caribbean, we serve multiple geographies around the world integrating security and fraud prevention solutions with the support of the best qualified manufacturers in this field.

We are ready to strengthen your cybersecurity. Contact us and let’s talk.

Request a demonstration of our products or contact one of our specialists.

✉️ info@telnorm.com

MX +52 55 5265 9915

CO (+571) 4660864-4660865

CALA +1 214 281 8918 Ext 408

USA 1(214)281-8918